Welcome to the home of

2025 Emerging Experience Study!

Download the 3rd edition of the Emerging Experience study, uncovering insights into the future of restaurants. This year's study was designed to test emerging formats against traditional benchmarks on key performance metrics, like speed, accuracy, friendliness, and satisfaction. Get ready to see the impact of technological innovation on QSRs!

Research Methodology: How we collected data?

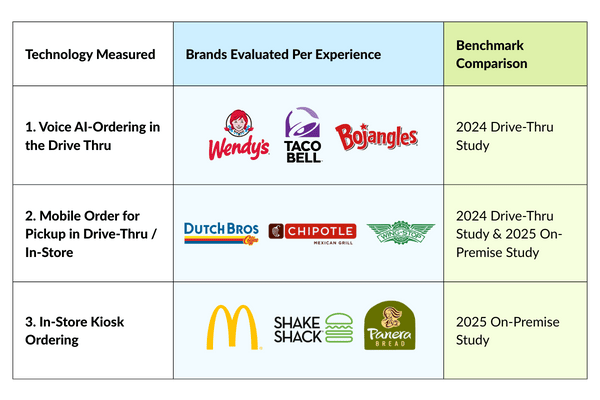

Leveraging our network for mystery shoppers, we performed 360 visits across 9 major QSR brands. The goal? To provide directional data that helps multi-location restaurants understand how emerging technologies—like Voice AI, kiosks, and mobile ordering—are reshaping the guest experience.

-

Benchmark Performances

To make comparisons even more meaningful, we combined mobile ordering for pick-up—whether at the drive-thru or in-store—into a single, unified experience. We also layered in fresh industry benchmarks, including the 2024 Drive-Thru and 2025 On-Premise Studies, giving you a richer view of how these innovations are performing compared to traditional experiences.

-

No. of Mystery Shops

For each participating brand, we conducted 40 mystery shops to evaluate how customers interact with emerging ordering technologies. -

Technology Evaluated

The study looked at three different experiences: In-store kiosk ordering, Mobile ordering for Drive-thru and In-store pickup, and Voice-AI ordering in the Drive-thru.

-

Timing

This study was conducted in January 2025, with mystery shops taking place during lunch or dinner.

-

Brand Mix

In our third annual report, we shook up the brand mix. Five brands from 2024 were replaced with four new ones for 2025: Bojangles, Dutch Bros, Wingstop, and McDonald’s—bringing fresh insights from a wider variety of QSR models.

Inside the report: What’s leading, lagging & gaining ground.

Did you know that over 1 in 4 US consumers prefer takeout to delivery, often opting for the chance to leave home? This study provides valuable data to guide your investment decisions and improve your customers' ordering and pickup experiences.

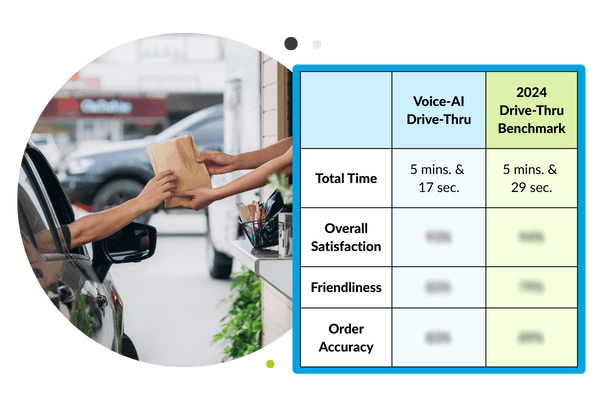

Voice AI speeds up the drive-thru

According to QSR Magazine, the restaurant AI market is valued at $9.68 billion in 2024 and is projected to reach $49 billion within five years.

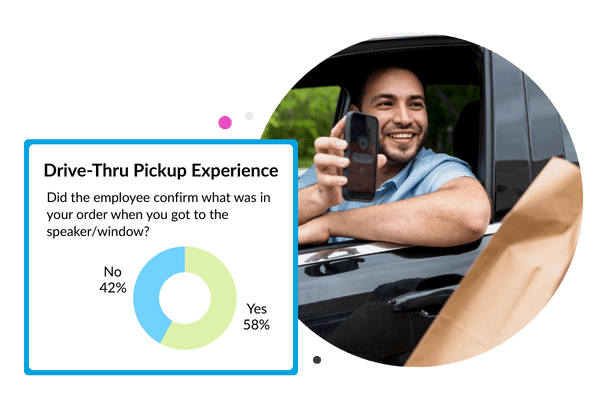

In this study, we tested Voice AI at the drive-thru and compared it to results from our 2024 Drive-Thru benchmark study, where shoppers ordered through an employee. Voice AI came out ahead—delivering on speed of service with shorter wait and total time.

Download the full report for deeper insights on employee intervention rates and how customers rated the system.

Mobile ordering saves time

When it comes to pick-up orders, mobile ordering isn’t just convenient—it’s faster and offers personalization.

For in-store pick-up, shoppers who ordered ahead on their phones spent 3 minutes and 31 seconds less time in the drive-thru than those who ordered the traditional way. And for drive-thru pick-up, mobile orders shaved off 1 minute and 54 seconds compared to the benchmark.

See how mobile tech is transforming both sides of the counter. Download the full report to learn more about order accuracy, friendliness ratings, and upsell offers.

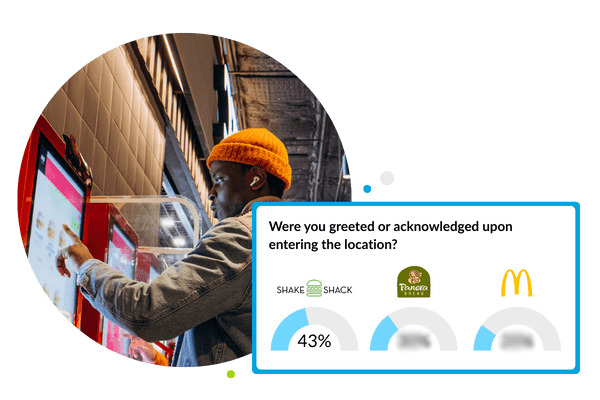

Kiosks deliver speed and customization—but at a cost

Kiosk ordering continues to offer guests a fast, intuitive, and customizable way to place their orders. But there's a trade-off: with limited face-to-face interaction, friendliness scores took a hit, landing at just 66%, which is lower than any other ordering method in this study and below the benchmark from our On-Premise Study.

Download the full report to explore how guests rate the kiosk experience across speed, accuracy, and overall satisfaction.