Third-Party Delivery Report 2025.

The 2025 Third-Party Delivery Report offers an unfiltered look at how today’s biggest third-party delivery apps and foodservice brands show up at the door. New this year, first-party delivery enters the mix and offers operators a fresh benchmark against third-party performance. Whether you run a multi-location QSR chain, an independent restaurant, or a convenience store chain, these delivery insights will give you a sharper view of what your customers really experience.

THE REPORT MEASURES FOUR KEY ASPECTS ACROSS THREE LEADING THIRD-PARTY FOOD DELIVERY PARTNERS.

The key takeaways.

2024 revealed the gap between delivery promises and real outcomes. 2025 became the year of recalibration. Here’s how the landscape evolved.

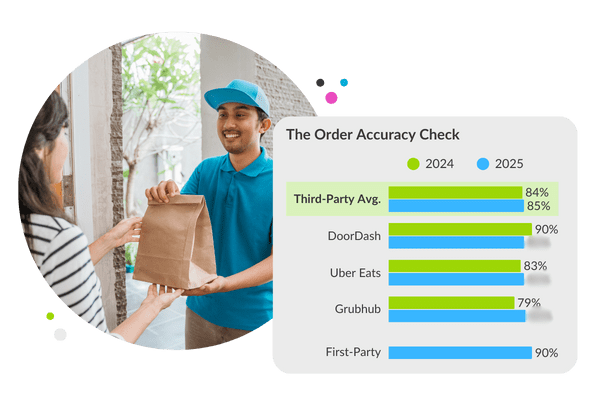

Order Accuracy is catching up with expectations

Third-Party platform accuracy improved by 1 percentage point in 2025. C-stores made the biggest leap, up 5 percentage points, while restaurants dipped slightly by 1 point. As a result, the gap between the two is shrinking quickly from 13 points in 2024 to just 7 this year.

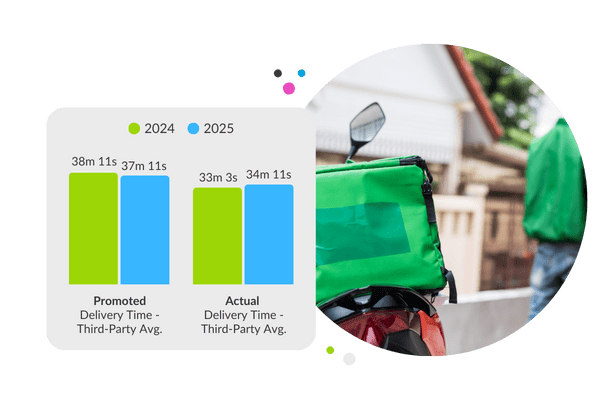

Is timing still a weak spot?

Average promoted delivery times on third-party apps were shorter by a minute in 2025, driven by a particular provider cutting down over five minutes from their commitments. Actual delivery times also took longer by just over a minute. Resulting in customers receiving their food later than the promoted time.

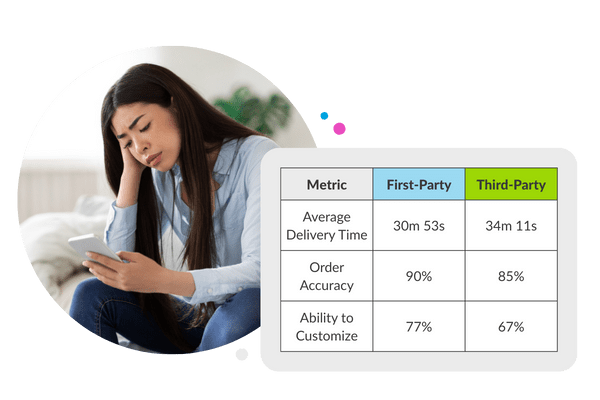

Who's winning between First-Party and Third-Party

First-Party apps made a strong showing with faster delivery, higher order accuracy, and more customization options compared to third-party platforms. The caveat is that one in three orders placed through a first-party app was still fulfilled by a third-party courier.

Which partner is charging the most

Delivery got cheaper this year, with DoorDash leading the pack by lowering fees $1.82 from last year. Across all platforms, the average drop was $1.10.

Empowering your delivery choices.

This report underscores the importance of choosing the right delivery partner and optimizing operations to enhance customer experience. Four key aspects that we measured in the report:

-

Speed of Service

Speed Matters. It's a top priority for third-party delivery services. To gauge performance, our shoppers tracked the promised delivery time, the estimated time given after placing the order, and the actual delivery time.

-

Order Accuracy

In a recent survey, North American consumers ranked order accuracy as the top factor. In our study, which included both pre-packaged and made-to-order items from convenience stores, monitoring this aspect was crucial. While order accuracy primarily depends on the food establishment, food temperature management is within the driver’s control.

-

Delivery & Service Fees

Curious about what drives delivery and service fees? It's all about the timing of the order and the distance between the restaurant and the delivery location. Our study reveals which delivery services charge the most.

-

Overall Experience

To wrap things up, we took a closer look at how satisfied consumers were with their full delivery experience including delivery speed, food temperature, fees, and more. We also broke down how satisfaction varied between restaurant and convenience store orders.

Research Methodology: How we collected the data

With the help of our extensive mystery shopper network, we performed 600 mystery shop orders across the U.S. Shoppers placed orders using either a first-party brand app or a third-party delivery app; no paid tiers or priority delivery were allowed!

Mystery Shop Allocation

We evaluated 150 orders on each third-party platform (Uber Eats, DoorDash, and Grubhub) and another 150 through first-party brand apps, with both sets balanced between convenience stores and quick-serve restaurants.

Timing

600 mystery shops geographically spread across the United States between April and June 2025. Orders were placed between the hours of 5:00 a.m. and 11:00 p.m. to capture a wide range of dayparts and operational realities.

Metrics Measured

The study evaluated four key factors that influence consumer choice: Speed of Service, Order Accuracy, Delivery, Fees, and Overall Experience.