Latest On-Premises QSR Experience Study.

How do ten leading QSRs make the counter experience count?

Intouch Insight’s first-ever On-Premises Study evaluates in-person guest experiences and reveals what really drives customer satisfaction at the counter.

WHO’S IN THE MIX? 10 WELL-KNOWN, CONSUMER LOVING QSR BRANDS.

Inside the Report: How greetings, communication, and accuracy shape the On-Premises Experience.

Want more? On-Premises study offers a valuable benchmark for comparing performance across other touchpoints like drive-thru and third-party delivery.

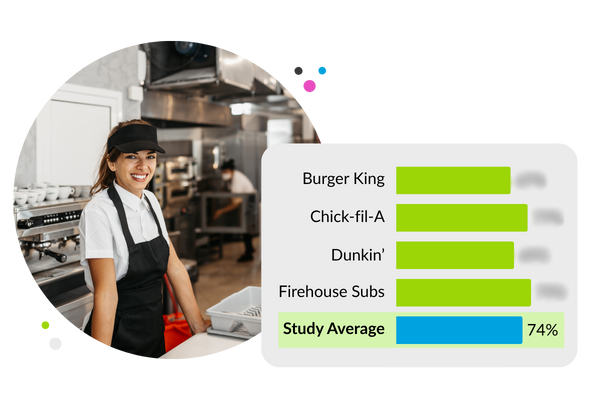

First impression matters

A simple greeting can significantly influence a customer's perception. The study found that when staff greeted customers upon entry, overall satisfaction and perceived friendliness increased. Conversely, the absence of a greeting made even efficient visits feel impersonal and transactional.

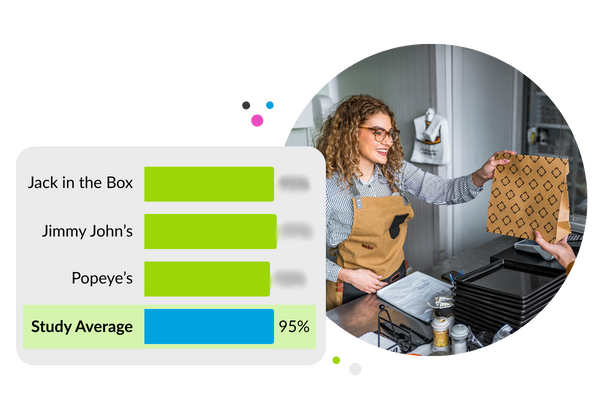

Clear communication enhances accuracy

While order accuracy averaged an impressive 95%, the study revealed that clear communication during the ordering process further elevated customer satisfaction. Customers felt more confident and satisfied when staff clearly communicated expectations and order details, highlighting the importance of effective communication alongside accuracy.

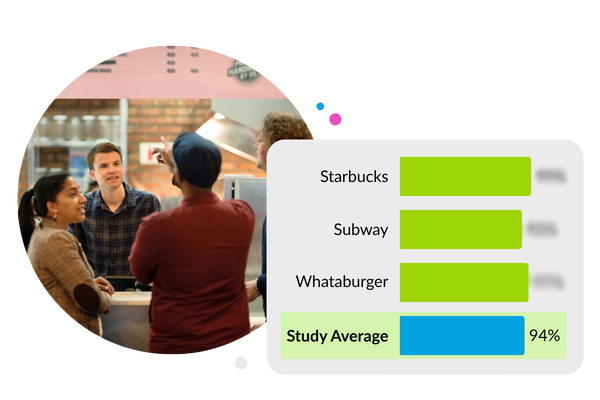

Speed is good but engagement is better

Quick service is expected, but the study showed that when staff engaged with customers during short waits, satisfaction levels remained high. In contrast, when delays occurred without any staff interaction, overall satisfaction dropped sharply.

The key experiences that matter.

-

Level of Service & Friendliness

It’s often the small details that make the biggest impact. A smile, a warm hello, or a kind word can turn a simple interaction into a memorable one. We also looked at service touches like suggestive selling, guiding customers where to wait, and helping them identify their order.

-

Order Accuracy & Quality

How would you feel if your order was wrong? Mistakes frustrate customers and cost loyalty. But accuracy isn’t the whole story because taste and temperature of the main item can make or break the experience. That’s why we explored how these factors shape customer satisfaction.

-

Speed of Service

It’s universal - fast, seamless service can turn a one-time visitor into a regular. That’s why we focused on two key metrics that shape the experience: average service time and customer satisfaction with speed of service.

-

Overall Experience

Eventually, we explored the overall experience—evaluating satisfaction by daypart, order experience, and pickup. From the clarity of pickup instructions to whether the ordering experience felt friendly or neutral, every interaction was rated by shoppers to gauge satisfaction.

Research Methodology: How we collected the data

The study evaluated 10 QSR brands, with 75 mystery shops conducted per brand across geographically distributed locations in the US, covering lunch, snacks, and dinner dayparts.

Mystery Shop Allocation

A total of 750 orders were completed across 10 QSR brands. Mystery shoppers purchased one main, one side, one beverage and made one customization (no ketchup for example).

Timing

The study was conducted in January 2025. Shoppers were allowed to go any day of the week and order during any daypart of their choice - lunch (10:31 am - 1:30 pm), snacks (1:31 pm - 4:00 pm) and dinner (4:01 pm - 7:00 pm).

Metrics Measured

The study measures four key metrics: level of service & friendliness, order accuracy & quality, speed of service and overall experience.